[Engineering Insurance]

Ensuring the smooth running of your business

CONTRACTORS ALL RISK (CAR) INSURANCE

The Contractor All Risks insurance is specially designed to cover for loss or damage to predominantly civil engineering construction projects from small villas to commercial construction projects such as high rise buildings, malls, bridges etc. The policy also covers injury to workers on site as well as third party subcontractors.

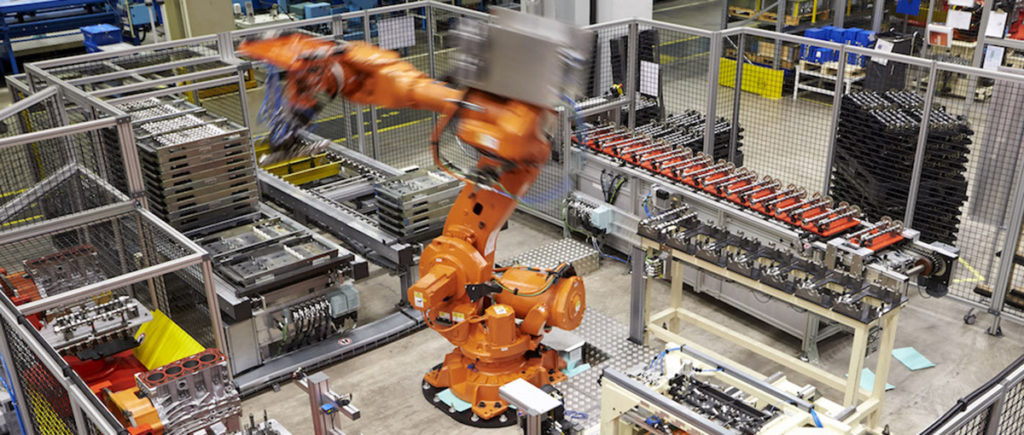

ERECTION ALL RISK (EAR) INSURANCE

EAR policies are designed to cover the risk of loss arising out of the erection and installation of machinery, plant and steel structures, including physical damage to the contract works, equipment and machinery, and liability for third-party bodily injury or property damage arising out of these operations.

ELECTRONIC EQUIPMENTS INSURANCE

Electronic Equipment Insurance provides comprehensive coverage for your electronic equipment. It includes physical loss or damage to all electronic equipment and data media, as well as the increased cost of working resulting from an Accidental and unforeseen physical loss or damage to the electronic equipment.

MACHINERY BREAKDOWN INSURANCE

Machinery Breakdown Insurance provides effective insurance cover for plant, machinery and mechanical equipment at work, at rest or during maintenance operations. It covers unforeseen and sudden physical loss of or damage to the insured items, necessitating their repair or replacement.

BOILERS EXPLOSIONS INSURANCE

While Fire Insurance also covers damage to assets from explosions, damage to boiler or pressure plant itself is not covered in the Fire policy. Damage to boiler and pressure plant due to an explosion can only be covered through this policy. The policy provides coverage for all types of boilers and other pressure plants.

CONTRACTORS PLANT & MACHINERY INSURANCE

Contractor’s Plant & Machinery Insurance covers unforeseen and sudden physical loss of or damage to the insured items, hence necessitating their repair or replacement. The cover, which excludes internal breakdown, applies at work, at rest or during maintenance operations and is not limited to a specific construction site.

MARINE / STORAGE CUM ERECTION INSURANCE

This insurance offers protection to principal and contractors and also to manufacturers and suppliers erecting machinery and plant etc. against financial loss due to any unforeseen causes resulting in loss or damage to the property insured at the project site whilst being stored, erected, tested and commissioned.

[CONTRACTORS ALL RISK (CAR) INSURANCE]

The Contractor All Risks insurance is specially designed to cover for loss or damage to predominantly civil engineering construction projects from small villas to commercial construction projects such as high rise buildings, malls, bridges etc. The policy also covers injury to workers on site as well as third party subcontractors.

This is an “All Risk” policy covering various activities of construction (except specific exclusions as mentioned in the policy).

This policy can be taken out in the joint names of the contractor and the employer. This policy enables the Contractor or Employer to comply with the insurance requirements of the contract. The Cover can be extended to include constructional plant as part of the Contractor All Risks cover.

Summary of Cover

- Contractors all risk Policy (Section 1) covers the risk of accidental physical loss or damage in respect of the contract works, during the execution of a civil project. CAR insurance provides an ‘all risk ‘cover. All perils are covered unless specifically excluded

- Section 2 of the policy covers legal liability falling on the insured contractor as a result of bodily injury or property damage belonging to a third party .

- The cover starts on the unloading of the first consignment at site or commencement of work and continues to be in force as stated in the policy. The policy ceases when the project is handed over to the principal or put into service.

- Period of Insurance – Should not be less than the period of contract.

- Sum to be insured is the full Contract project value (inclusive of transport charges, customs duties, etc.) and supplemented as necessary by the value of constructional plant.

- On request the policy can be extended to cover various optional extensions viz. Transit to or from the site (excluding sea or air transit), Maintenance cover, Removal of debris costs, Architects, Surveyors Fees for the reinstatement of damage, etc.

A few Exclusions are listed below

Please refer to the main policy for full comprehensive list of exclusions.

- War, Civil War, Political Risk

- Terrorism and Sabotage

- Nuclear reaction, nuclear radiation or radioactive contamination.

- Willful act or willful negligence of the insured or his representatives.

- Cessation of work whether total or partial.

- Losses within the compulsory access.

- Loss due to faulty design

- Wear and tear

- Loss or damage discovered at the time of taking an inventory.

How do I purchase this policy?

Please fill out the Proposal Form below and send it to us. One of our agents will be in touch with you shortly

[ERECTION ALL RISK (EAR) INSURANCE]

EAR policies are designed to cover the risk of loss arising out of the erection and installation of machinery, plant and steel structures, including physical damage to the contract works, equipment and machinery, and liability for third-party bodily injury or property damage arising out of these operations.

This is an “All Risk” policy covering various activities of erection/installation, testing and commissioning of plant and equipments (except specific exclusions as mentioned in the policy). It protects a contractor or employer against physical loss or damage to the contract works, construction plant and equipment or machinary. It also includes cover for damage to property of third parties and bodily damage to third parties.

The policy can be taken out in the joint names of the contractor and the employer. This policy enables the Contractor or Employer to comply with the insurance requirements of the Contract.

Summary of Cover

- This policy (Section 1) covers risks associated with storage, assembly/erection and testing of Plant and Machinery. EAR insurance provides comprehensive cover. All perils are covered unless specifically excluded.

- Section 2 of the policy covers legal liability falling on the insured contractor as a result of bodily injury or property damage belonging to a third party.

- The cover starts on the unloading of the first consignment at site or commencement of work and continues to be in force as stated in the policy including the test run period. The policy ceases when the project is handed over to the principal or put into service.

- On request the policy can be extended to cover various optional extensions viz. Transit to or from the site (excluding sea or air transit), testing and commissioning, maintenance cover, removal of debris costs, architects, surveyors fees for the reinstatement of damage, damage to surrounding property, etc.

- Period of Insurance – Should not be less than the period of contract.

- Sum to be insured is the completely erected value of the plant and machinery inclusive of freight, customs duties and cost of erection.

A few Exclusions are listed below

Please refer to the main policy for full comprehensive list of exclusions.

- Loss or damage due to faulty designs, defective materials and bad workmanship.

- Manufacturing defects in the machinery or the risks which fall within the scope of manufacturer’s guarantee.

- Loss or damage due to mechanical and electrical breakdown or damage not caused by any of the external risks covered by the Policy.

- Loss or damage due to willful act or willful negligence.

- Loss or damage due to wear and tear operations of civil commotion or order of any government authority.

- Loss or damage due to nuclear weapons, radiation and radioactive materials.

- Losses within the compulsory access.

How do I purchase this policy?

Please fill out the Proposal Form below and send it to us. One of our agents will be in touch with you shortly

[ELECTRONIC EQUIPMENTS INSURANCE]

Electronic Equipment Insurance provides comprehensive coverage for your electronic equipment. It includes physical loss or damage to all electronic equipment and data media, as well as the increased cost of working resulting from an accidental and unforeseen physical loss or damage to the electronic equipment.

This specially designed policy covers accidental loss or damage to electronic equipment such as the following:

- Electronic data processing machine.

- Telecommunication equipment.

- Transmitting and receiving installations(including Radio, TV, Cinema Sound Reproduction and Studio Equipment).

- Material testing and research equipment.

- Electro-Medical Installations.

- Signal and transmitting units.

Scope of Cover

This cover is arranged in three sections.

Section 1.

Material damage of the equipment on a comprehensive basis including both accidental damage and electrical and mechanical breakdown.

Section 2.

External Data Media, following a damage to EDP system and loss indemnifiable under Section 1, the cost incurred in restoring the data.

Section 3.

Increased cost of working is the additional expense incurred to restart the operation following a material damage loss.

How to select sum insured?

Section 1.

The sum insured shall be equal to the cost of replacement of the insured items by new and of the same kind and capacity which will include freight dues customs duties and erection cost.

The Sum Insured shall be equal to the cost required for restoring the insured external data media.

Section 2.

The Sum insured shall be equal to the amount which the insured would have to pay as additional expenditure for 12 months use of substitute EDP equipment.

Section 3.

The Sum insured shall be equal to the amount which the insured would have to pay as additional expenditure for 12 months use of substitute EDP equipment.

How do I purchase this policy?

Please fill out the Proposal Form below and send it to us. One of our agents will be in touch with you shortly

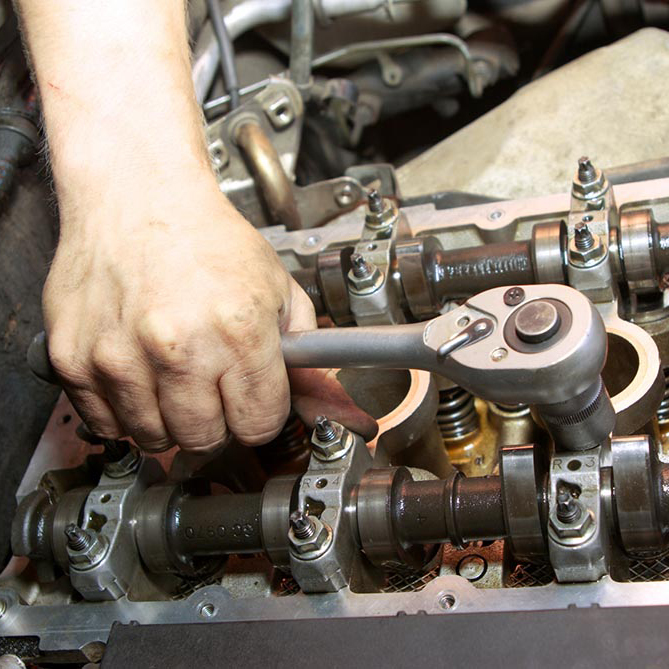

[MACHINERY BREAKDOWN INSURANCE]

Machinery Breakdown Insurance provides effective insurance cover for plant, machinery and mechanical equipment at work, at rest or during maintenance operations. It covers unforeseen and sudden physical loss of or damage to the insured items, necessitating their repair or replacement.

This Insurance covers all types of Machinery, Plant, Mechanical Equipment and Apparatus and this may also include boilers, turbines and generators. The Policy coverage includes any unforeseen and sudden physical loss or damage to the Insured items due to any of the following reasons:

- Faulty designs – faults at the workshop or in erection.

- Faulty in operation and failure of safety system, lubricating systems or controls including lack of skill and negligence of the employees.

- Tearing apart or failure due to the force generated by the machinery itself.

- Short circuit and other electronic causes.

- Shortage of water in boilers

- Faulty operation and damage due to human errors.

A few Exclusions are listed below

Please refer to the main policy for full comprehensive list of exclusions.

- Loss or damage caused by fire, lightning, chemical explosions, burglary and theft.

- Loss or damage due to faulty designs, defective materials and bad workmanship.

- Manufacturing defects in the machinery or the risks which fall within the scope of manufacturer’s guarantee.

- Loss or damage due to mechanical and electrical breakdown or damage not caused by any of the external risks covered by the Policy.

- Loss or damage due to willful act or willful negligence.

- Loss or damage due to wear and tear operations of civil commotion or order of any government authority.

- Loss or damage due to nuclear weapons, radiation and radioactive materials.

- Losses within the compulsory access.

How do I purchase this policy?

Please fill out the Proposal Form below and send it to us. One of our agents will be in touch with you shortly

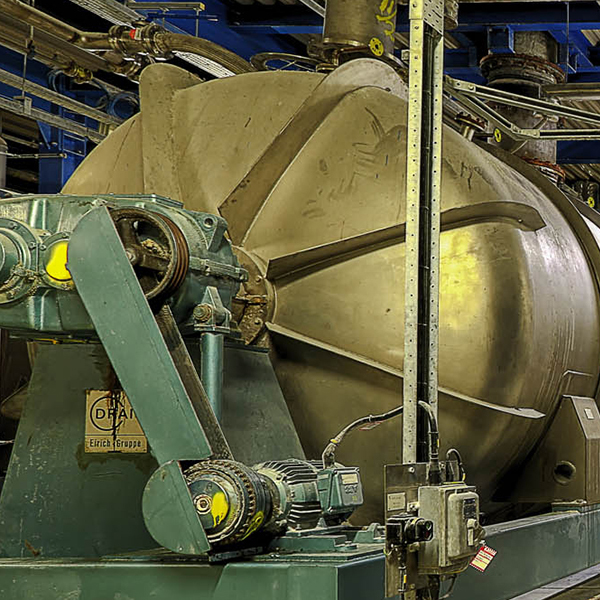

[BOILERS EXPLOSIONS INSURANCE]

A boiler is a pressure vessel that holds inner fluids like water and steam or is a pressurized vessel that is used for compressing and supplying other items like gases, oils and chemicals.

While Fire Insurance also covers damage to assets from explosions, damage to boiler or pressure plant itself is not covered in the Fire policy. Damage to boiler and pressure plant due to an explosion can only be covered through this policy. The policy provides coverage for all types of boilers and other pressure plants.

Explosion

All explosions can be broadly classified under the following two categories for the purpose of Insurance: Chemical Explosion & Physical Explosion.

Chemical Explosion is caused due to interaction of mechanical or thermal shock as in case of gases, detonator and other explosive compounds. In this case, a chemical reaction takes place giving rise to combustion and the resultant fire. The spread of fire is extremely rapid releasing substantial energy which explodes the particular pressure vessel. As a result, the boiler itself, surrounding property and loss or damage to Third Parties may result.

Under Insurance terminology, such explosions are covered under the fire Policy as the pre-dominant cause of explosions are the rapid and disastrous spread of fire. Under fire policies, the following damages caused by explosions are covered:

- Fire resulting from the explosions.

- Damage caused by the explosions to the boilers used for domestic purpose

- Damage caused by explosions of gas used for domestic purpose for lighting heating etc.

Therefore, the Boiler Explosions Policy does not cover chemical explosions but is restricted to physical explosions.

Physical Explosion can occur due to variations in the fluids or steam pressure. As items handled by the boiler are of inert nature there is no chemical reaction or chemical explosion.

Scope of Cover

All Pressure Plants and Steam boilers need to be inspected and certified annually for their safety in working. The Policy covers includes explosions and collapses of the boiler / pressure plant itself, damage to surrounding property of the Insured, liability of the Insured at Law for death and bodily injuries to Third Party and also damage to property belonging to others.

Exceptions:

- Loss or damage arising out of Fire and Allied Perils which can be covered under the fire Policy.

- Damage due to chemical explosions.

- Contrast liability, manufacturer’s or supplier’s liability and any kind of consequential loss due to loss of the use of the boiler.

- Losses arising from an existing defect.

- Failure of individual tubes of the boiler and other items relating to wear and tear of the boiler itself.

- Other exceptions are similar to other Engineering policies which are mentioned under Erection All Risks and Contractors All Risks Policy.

How do I purchase this policy?

Please fill out the Proposal Form below and send it to us. One of our agents will be in touch with you shortly

[CONTRACTORS PLANT & MACHINERY INSURANCE]

Contractor’s Plant & Machinery Insurance covers unforeseen and sudden physical loss of or damage to the insured items, necessitating their repair or replacement. The cover, which excludes internal breakdown, applies at work, at rest or during maintenance operations and is not limited to a specific construction site. The Policy is well suited for contractors and factories.

The Policy coverage includes any unforeseen and sudden physical loss or damage to the Insured items due to any cause including:

- Burglary, theft, riot, strike and malicious damage.

- Fire and lightning, External explosion, Earth Quake, Flood, Subsidence, Inundation, Landslide and Rockslide.

- Storm, tempest, hurricane, tempest, typhoon and tornado.

- Accidental damage while at work due to faulty man handling, dropping or falling or collapse, collision and impact.

The Insured shall be indemnified for any loss or damage to the insured item while it is being used/installed at the site against unforeseen and sudden physical damage to the machinery by any cause provided the same is not specifically excluded under the Policy.

Exceptions:

The policy shall not cover loss or damage due to the following:

- Electronic or Mechanical Breakdown failure or breakage without the operation of any external peril.

- Loss or damage to replaceable parts which have limited life such as bits, knives, ropes, belts, chains etc. etc.

- Loss or damage due to explosion of any boiler or pressure vessel.

- Loss or damage to any water borne vessel and crafts, sinking or damage by sea waters or tides.

- Loss or damage sustained during the transit from one location to another.

- Loss or damage due to wear, tear, collisions and depreciation.

- War and war-like situations including nuclear risks.

How do I purchase this policy?

Please fill out the Proposal Form below and send it to us. One of our agents will be in touch with you shortly

[MARINE / STORAGE CUM ERECTION INSURANCE]

This insurance offers protection to principal and contractors and also to manufacturers and suppliers erecting machinery and plant etc. against financial loss due to any unforeseen causes resulting in loss or damage to the property insured at the project site whilst being stored, erected, tested and commissioned.

This is a comprehensive policy covering all physical risks which a project is exposed to right from the warehouse of the supplier of equipments – whether imported or indigenous – to its erection, testing and commissioning at the site.

In case the supplier has arranged transit insurance upto the site, a storage cum erection policy can be issued limiting coverage to risks that the project is exposed to at the site only.

The policy comprises of 2 Sections:

Section I – Material Damage-covering physical loss, damage or destruction of the property insured by any cause, other than those specifically excluded in the policy.

Section II – Third Party Liability-covering the legal liability falling on the insured contractor as a result of bodily injury or property damage belonging to a third party.

The policy covers all risk of physical loss or damage of insured property other than those specifically excluded , including:-

1. Marine voyage for imports

2. Offloading / storage at port

3. Inland transit to site

4. Storage, handling, erection at site

5. Testing and commissioning at site

The main Exclusions are:

- Loss or damage due to faulty design, defective material or casting, bad workmanship other than faults in erection. This exclusion is limited to the items immediately affected and does not apply to any consequential loss to correctly executed items.

- Cost necessary for rectification or correction of any error during erection unless resulting in physical loss or damage.

- Loss or damage due to gradual deterioration, atmospheric condition, rusting etc.

- Loss discovered only at the time of taking inventory.

- Loss arising out of penalty for delay, non-fulfillment of terms of contract.

Add on covers

The policy can be extended to cover the following on payment of additional premium.

- Clearance and removal of debris

- Damage to owner’s surrounding property

- Maintenance visit / extended maintenance cover

- Additional customs duty

- Civil works

- Express freight

- Air freight

- Deletion of duration clause under marine

Who can take the policy?

The policy can be taken by the principal, contractor or sub contractor, jointly or separately.

How to select the sum insured?

The sum insured selected under section I should not be less than the completely erected value of the property inclusive of estimated freights, customs duty, erection cost etc.

In case of long term contracts, there is bound to be escalation in prices i.e.prime cost. The basic policy will pay only as per the original cost and prices. However escalation clause can be opted for, under which escalation upto 50%, can be selected to take care of such increase in prices during the policy period.

The sum insured shall be adjustable on completion of the erection, on the basis of actual values incurred by the insured in respect of freights, handling charges, customs dues, cost of erection etc. and premium adjusted accordingly.

The sum insured under section II should represent the per accident limit (the maximum legal liability that may fall on the insured as a result of an accident in the insured’s site). The limit per policy period should be fixed taking into account the maximum number of such accidents which can reasonably be expected to occur.

Period of Insurance

The period of insurance should not be less than the period of contract and should commence from the date of unloading of the first consignment at the site of the erection and shall continue upto the conclusion of the first test operation or test loading subject to a maximum of 4weeks from the date trial running is made and / or readiness for work is declared by the erectors. If a part of the plant or one or several machines are tested and put into the operation, the coverage under the policy for that particular part of the plant or machine will cease, whereas the coverage will continue for the remaining parts which are not yet ready.

In case approval of the plant or any part thereof is not given by the concerned authorities even after expiry of 4weeks of trial running, the policy can be extended and the extra premium to be arranged beforehand.

How do I purchase this policy?

Please fill out the Proposal Form below and send it to us. One of our agents will be in touch with you shortly